The financial crisis gripping Marion, Ohio, is not a recent event. It is a four-decade or longer story of systemic failure, where broken rules and compromised computer systems allowed insiders to commit and conceal fraud—a pattern we call “Silent Sabotage.” This crisis is confirmed by records showing severe breaches of global IT and financial standards dating back to at least 1983.

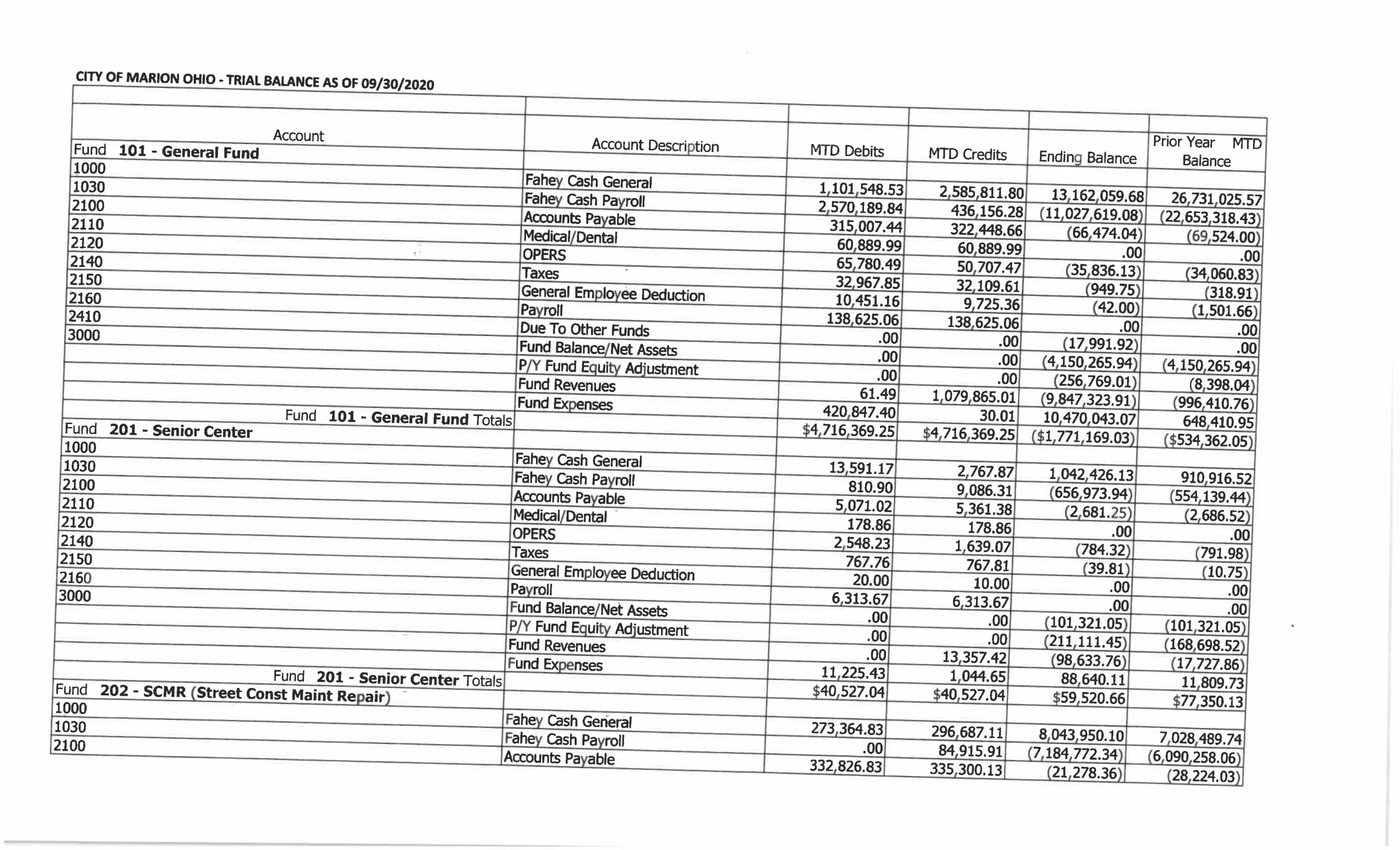

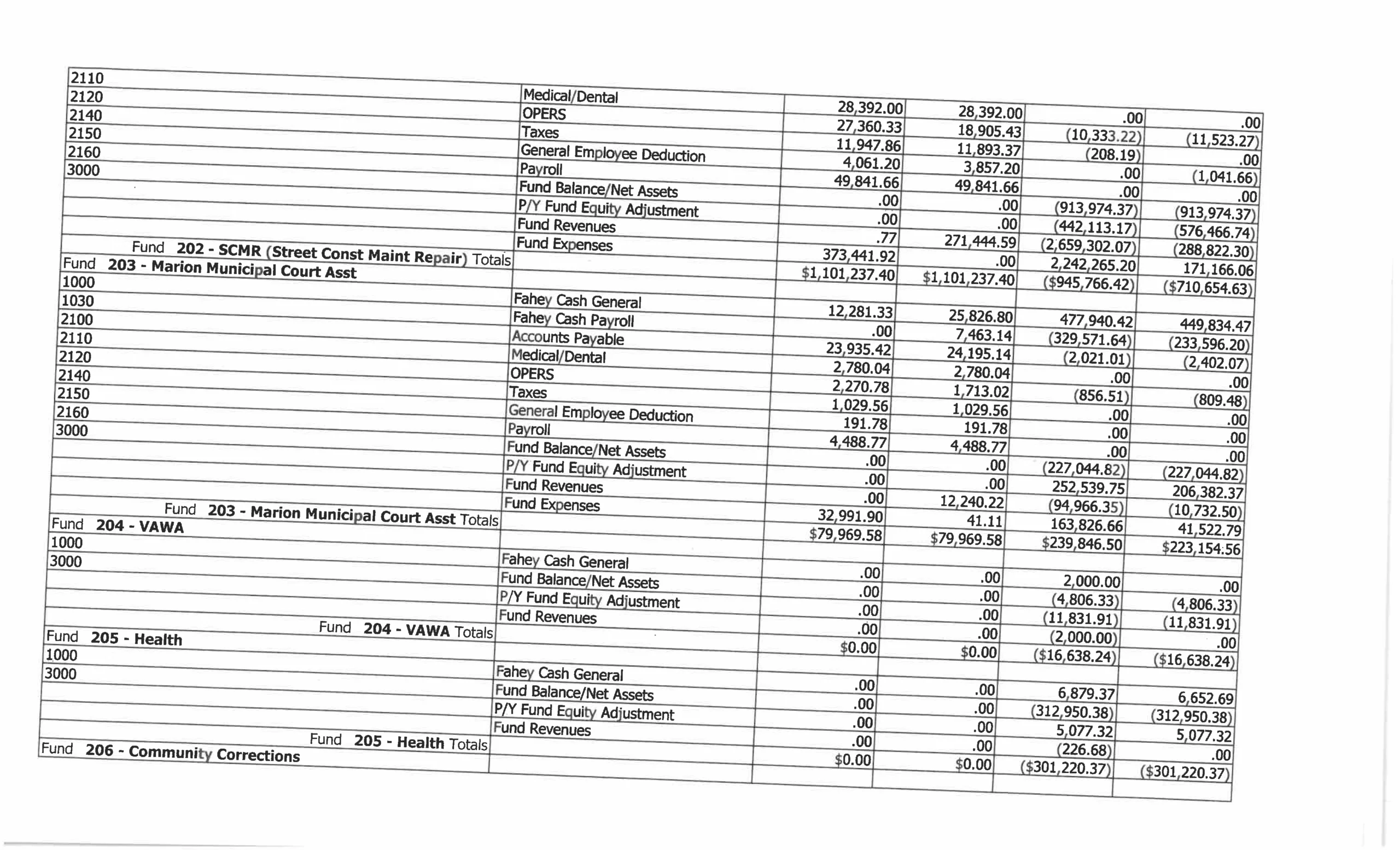

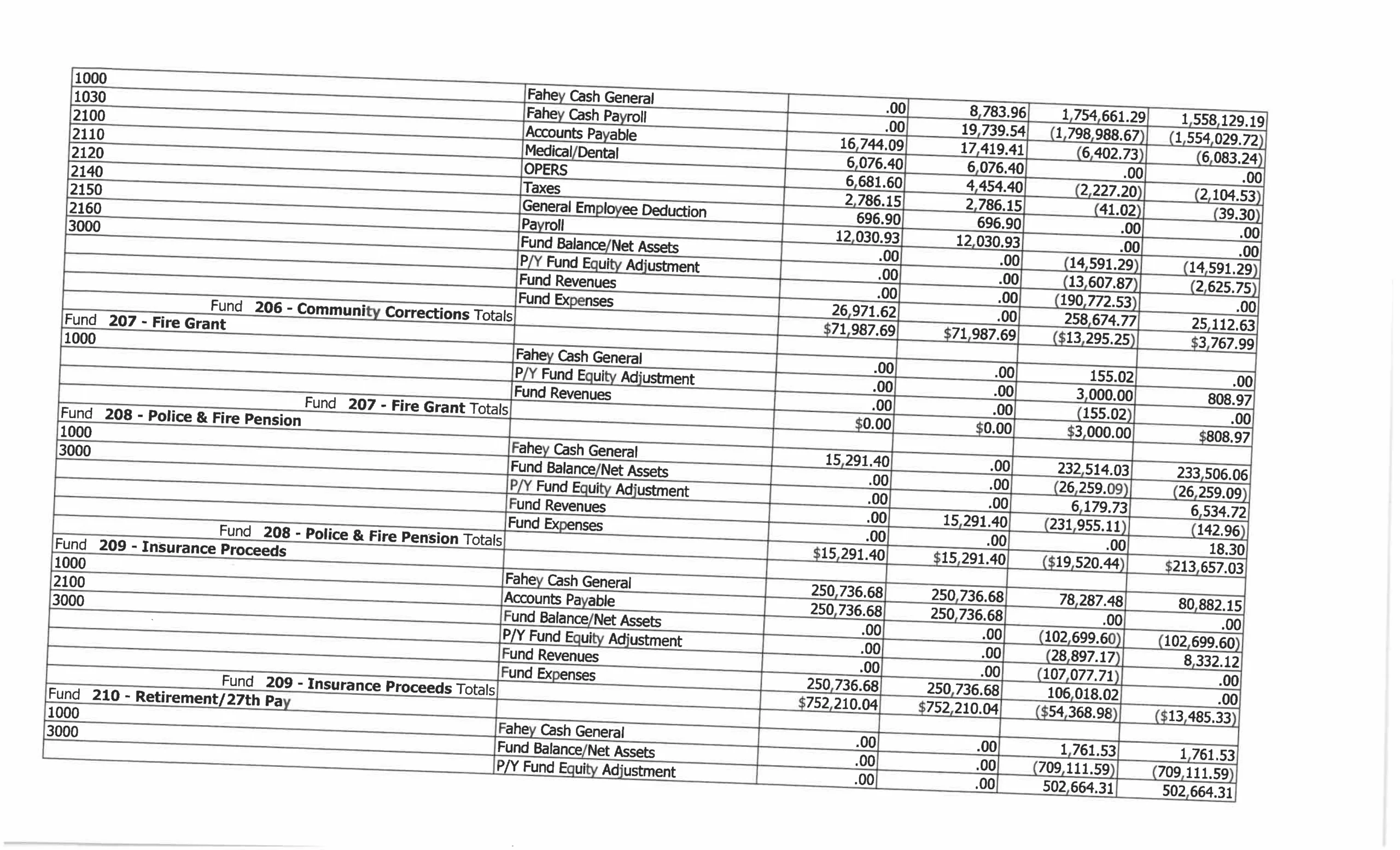

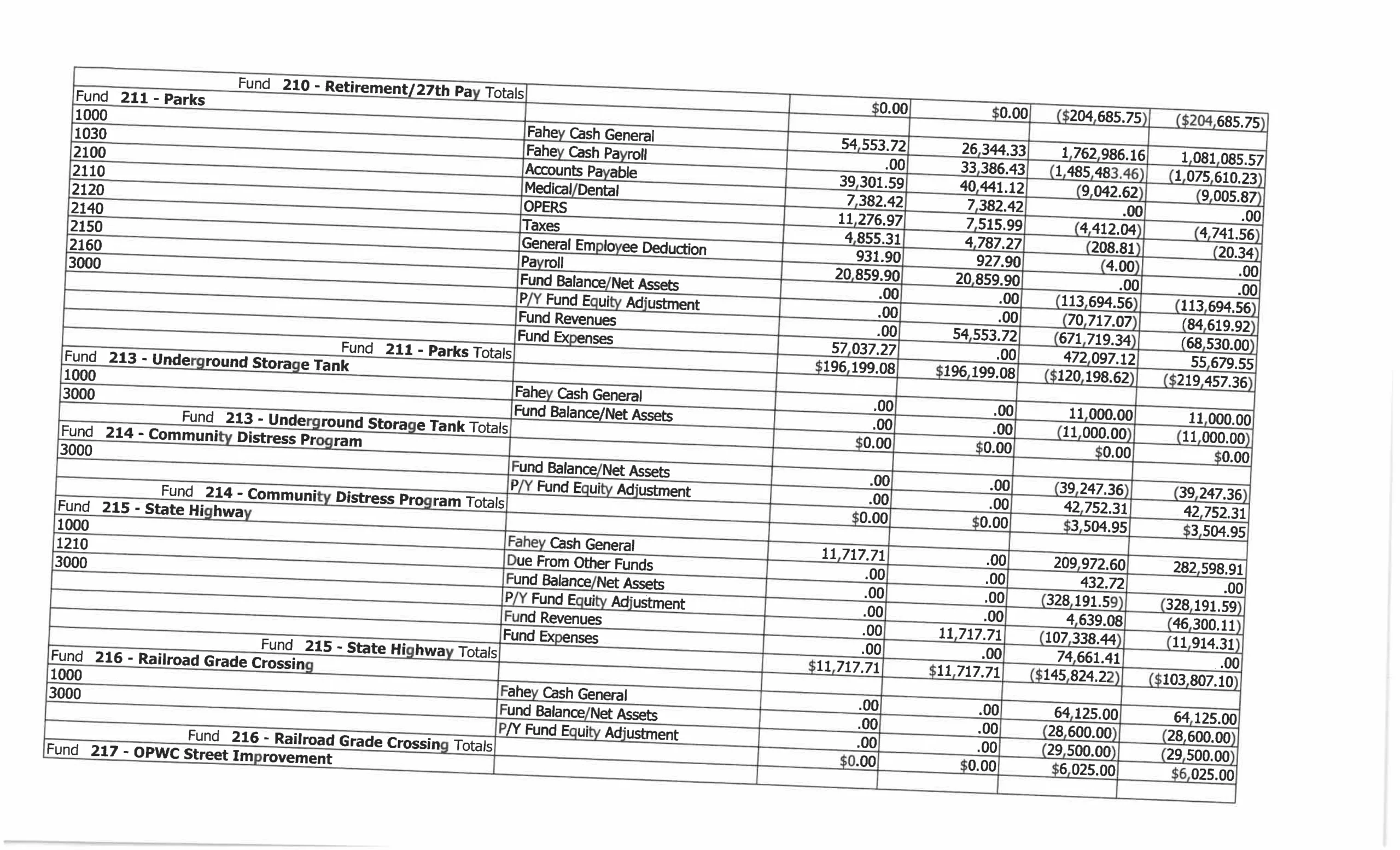

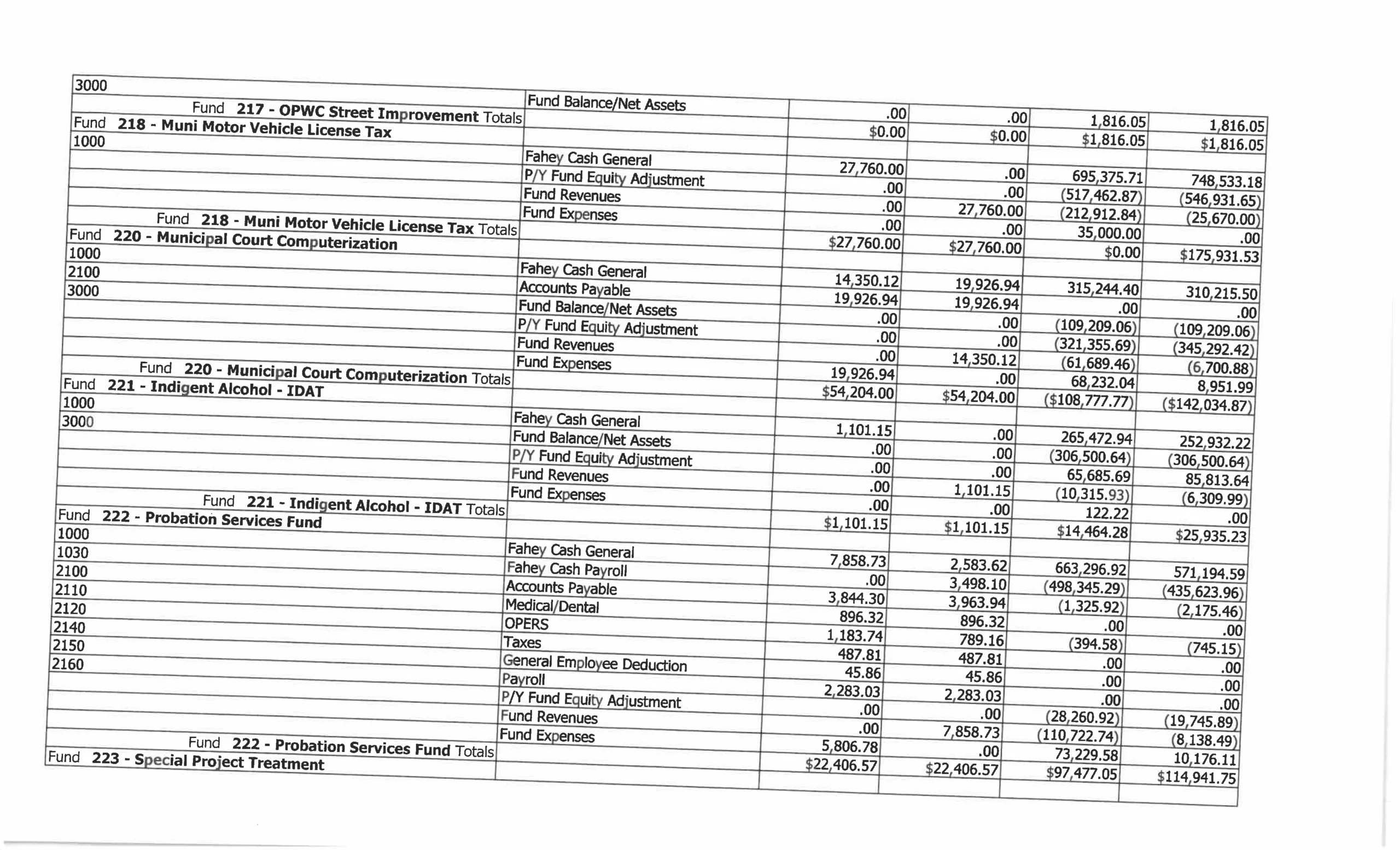

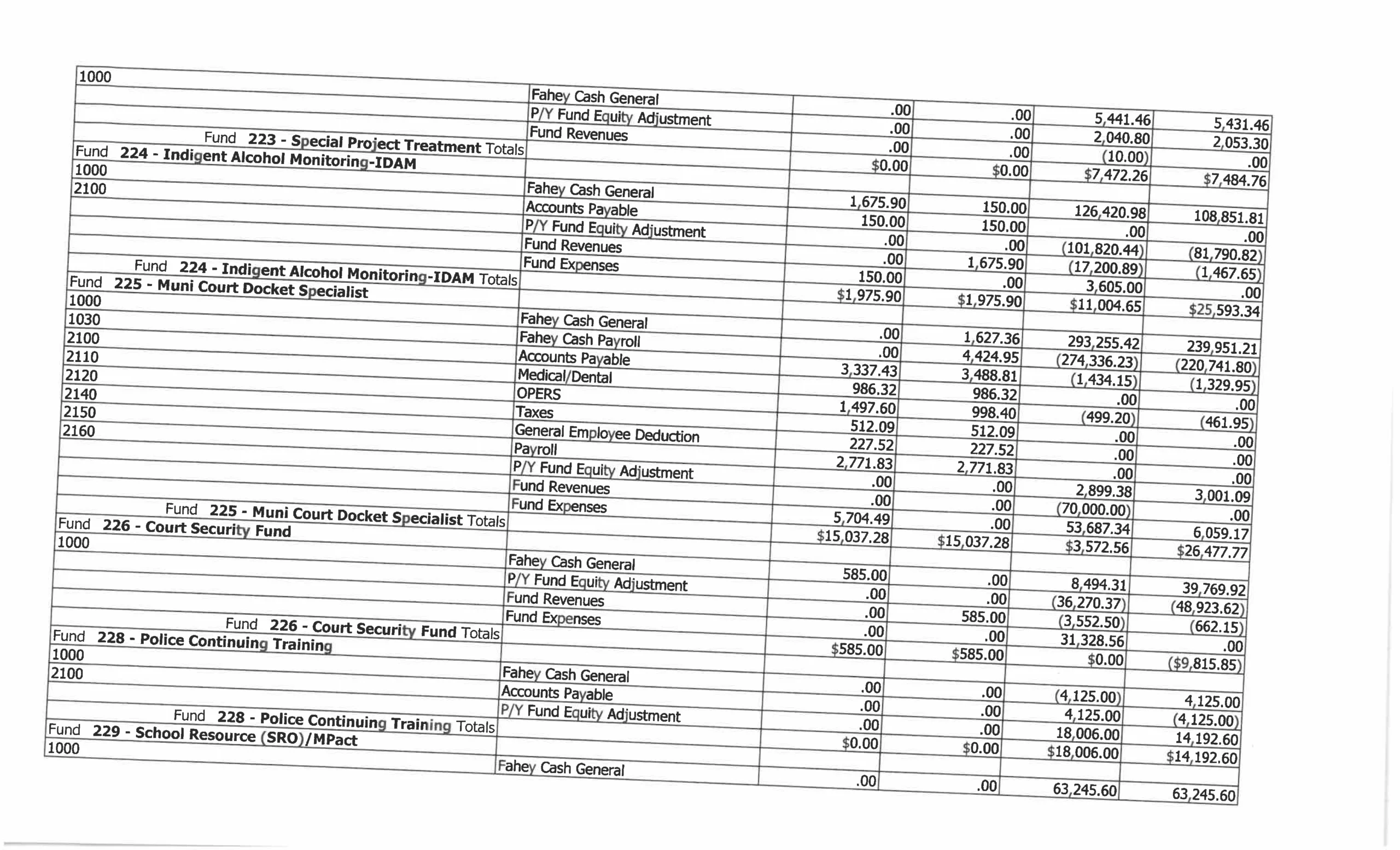

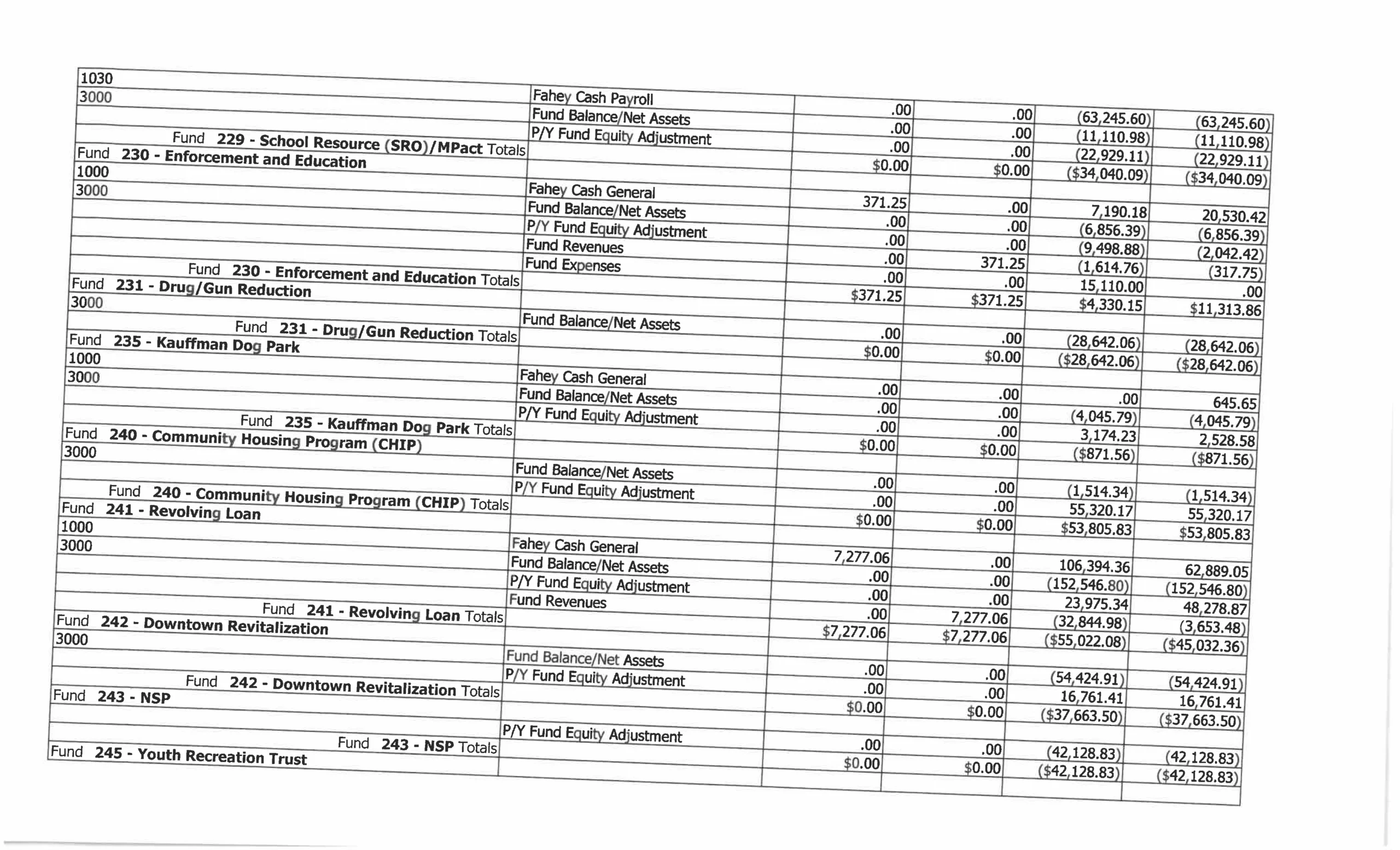

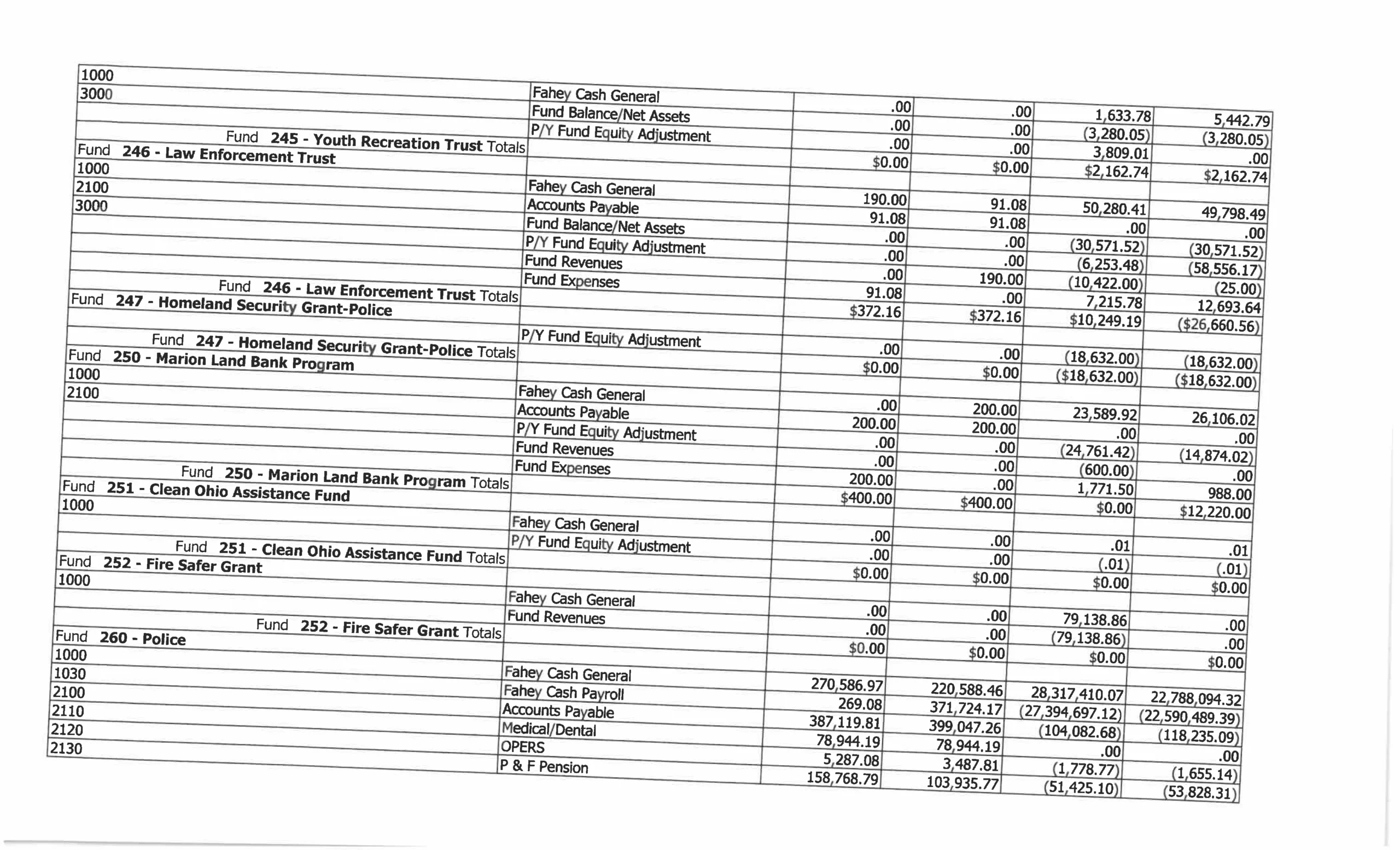

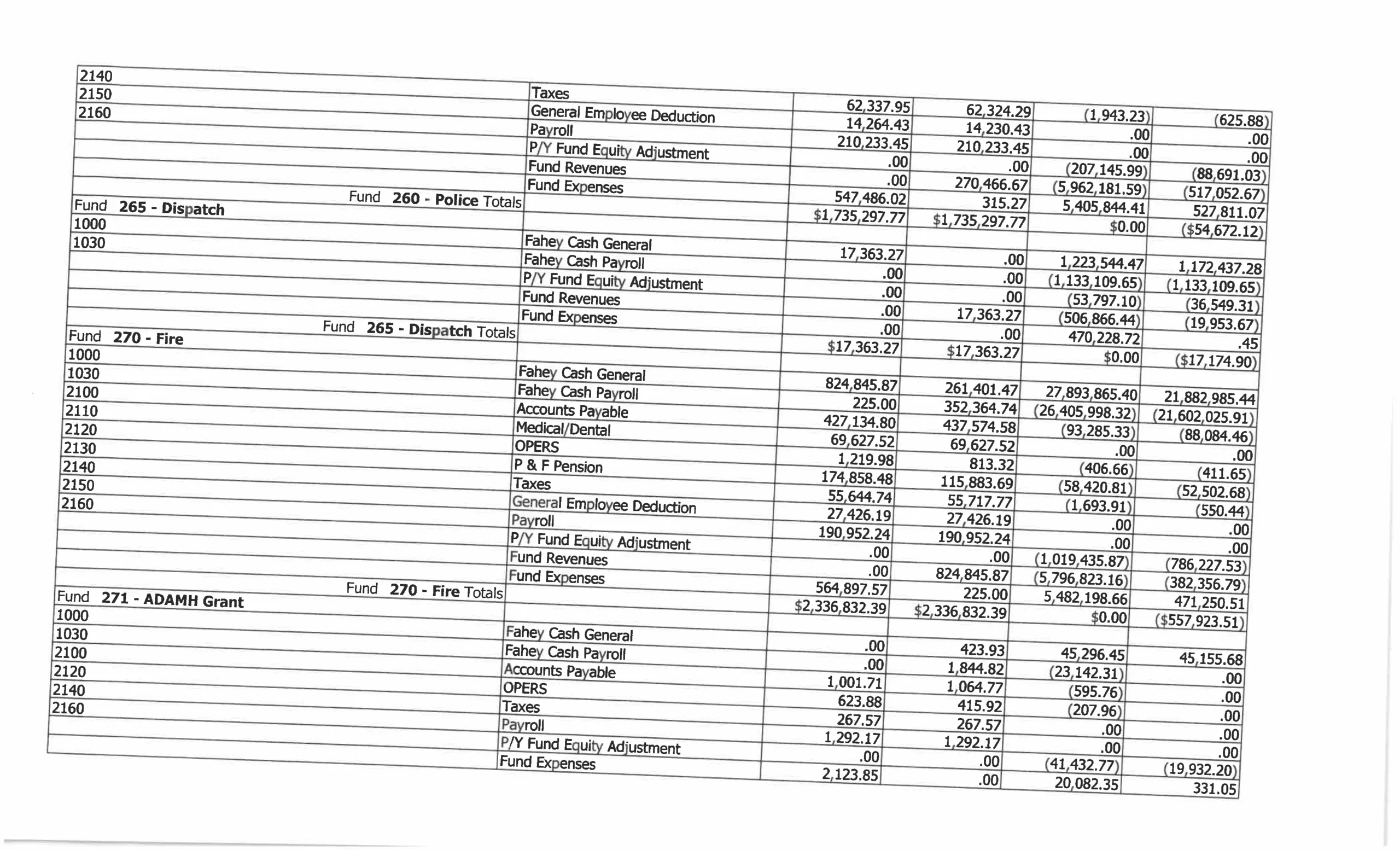

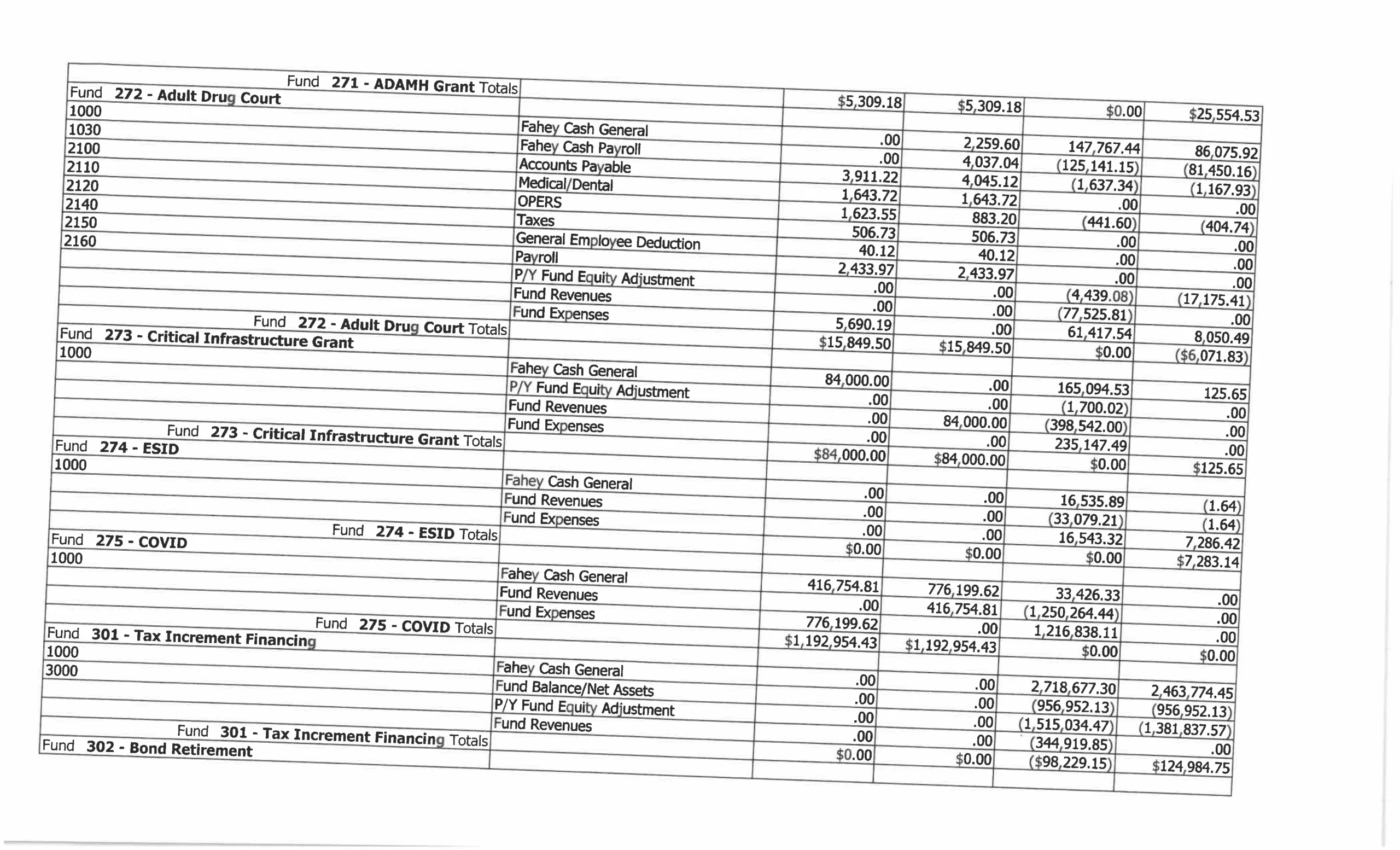

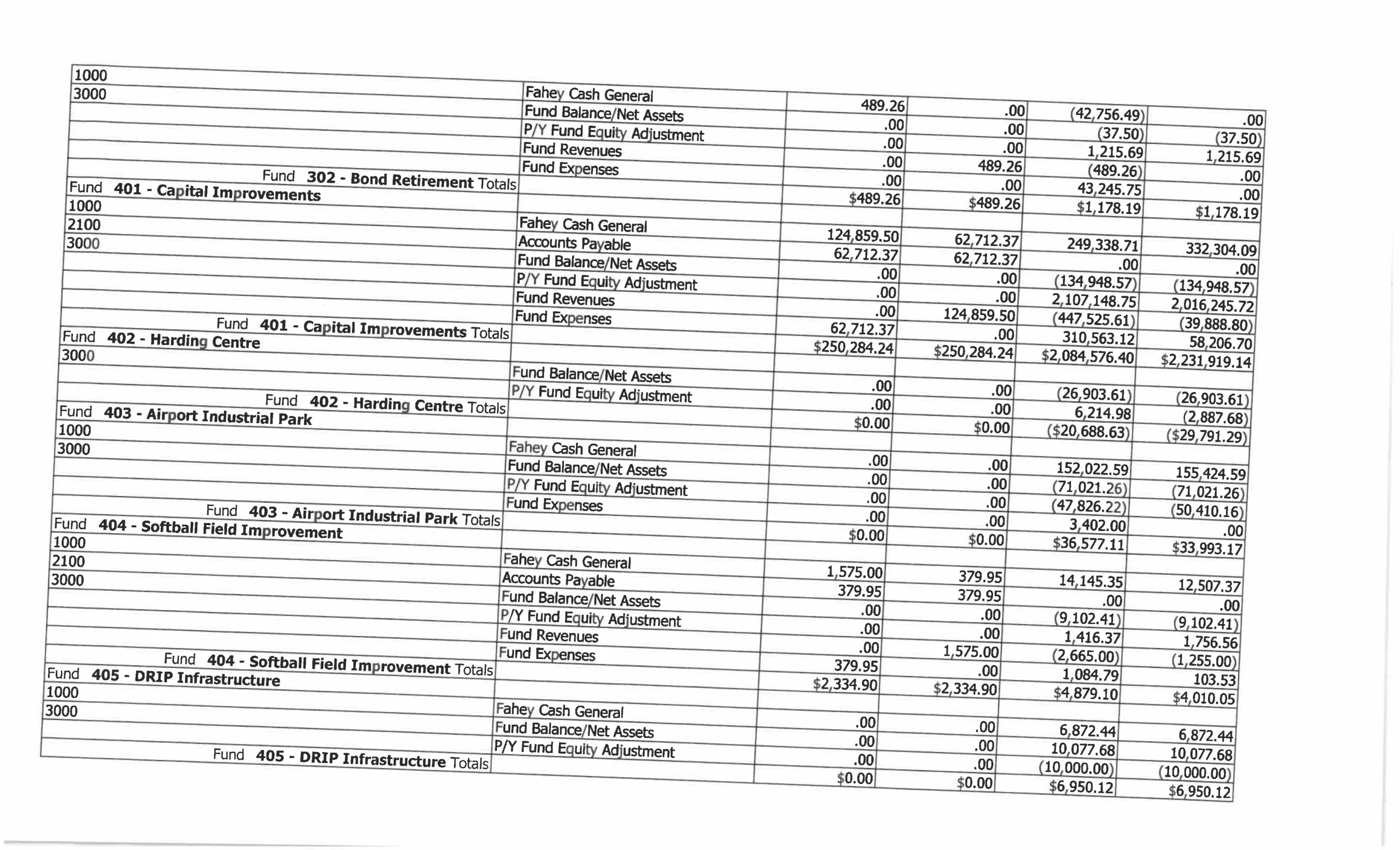

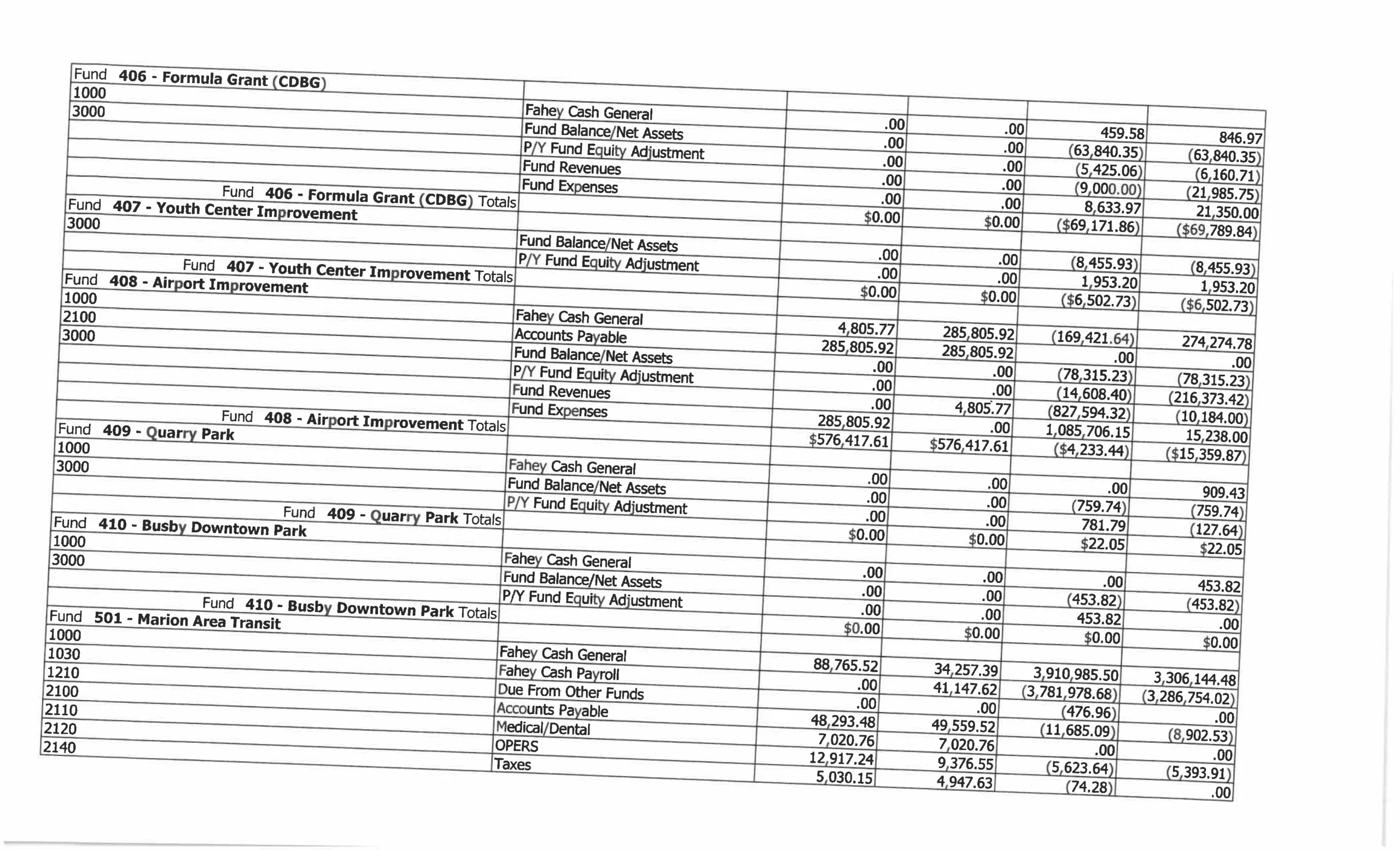

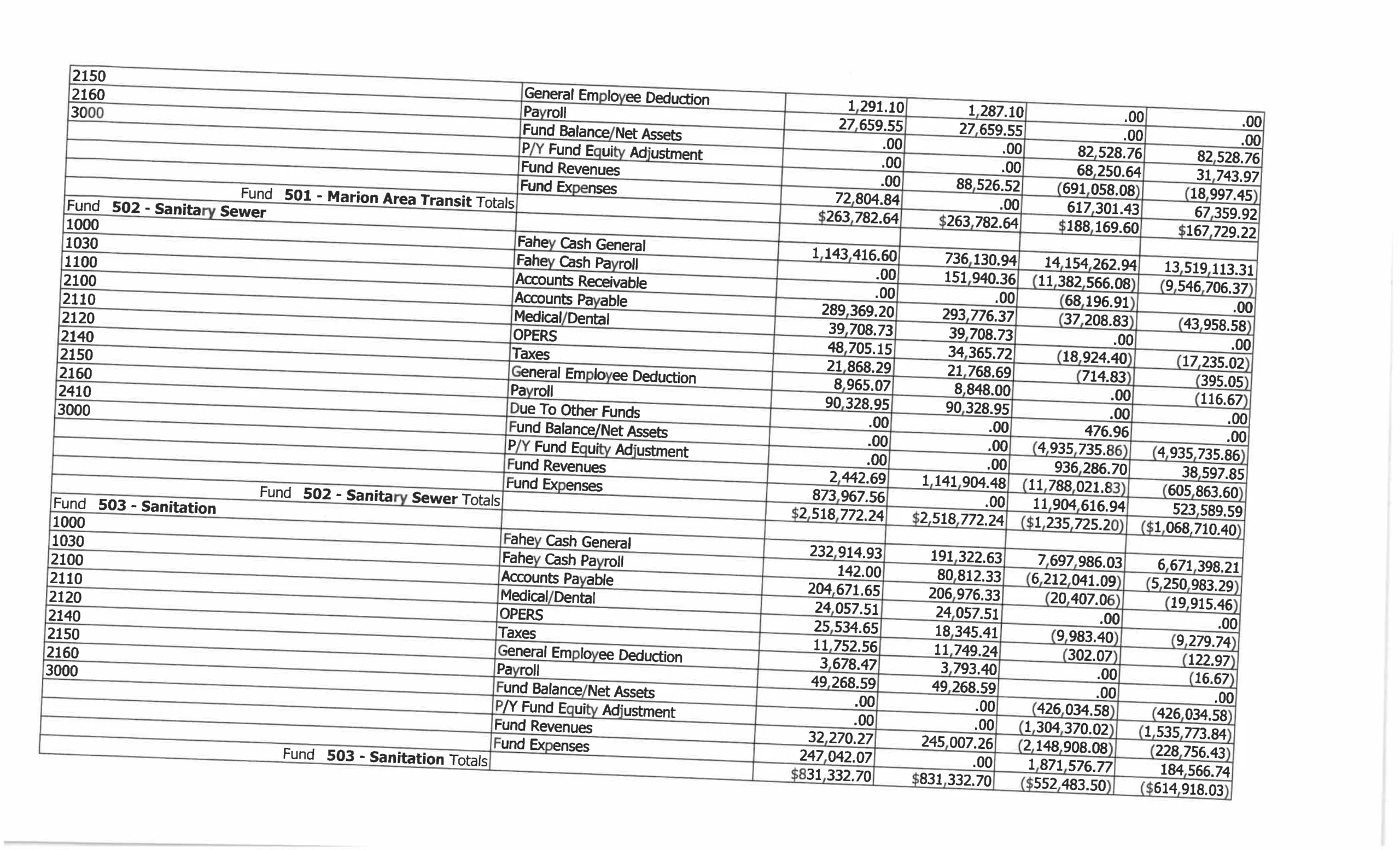

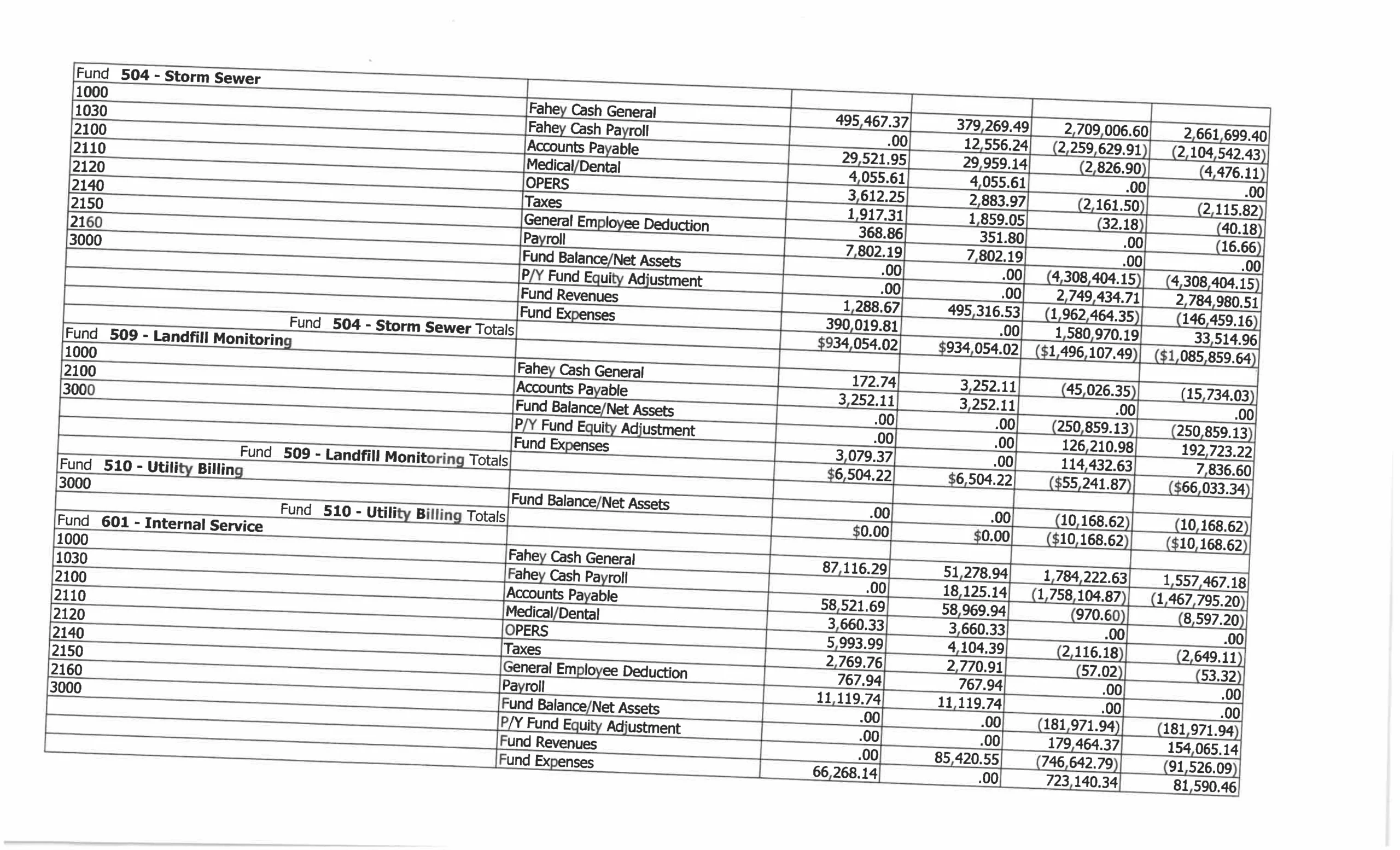

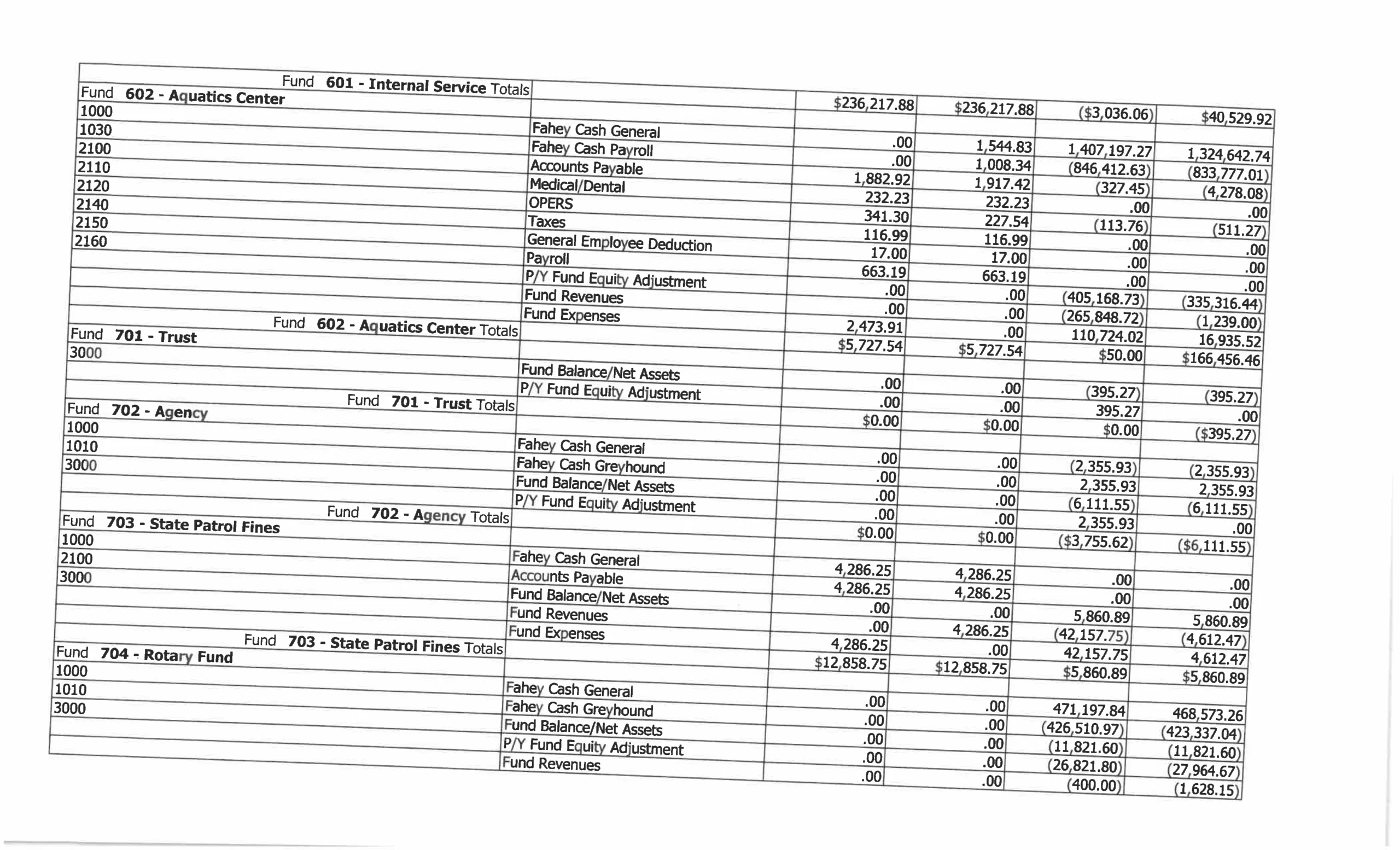

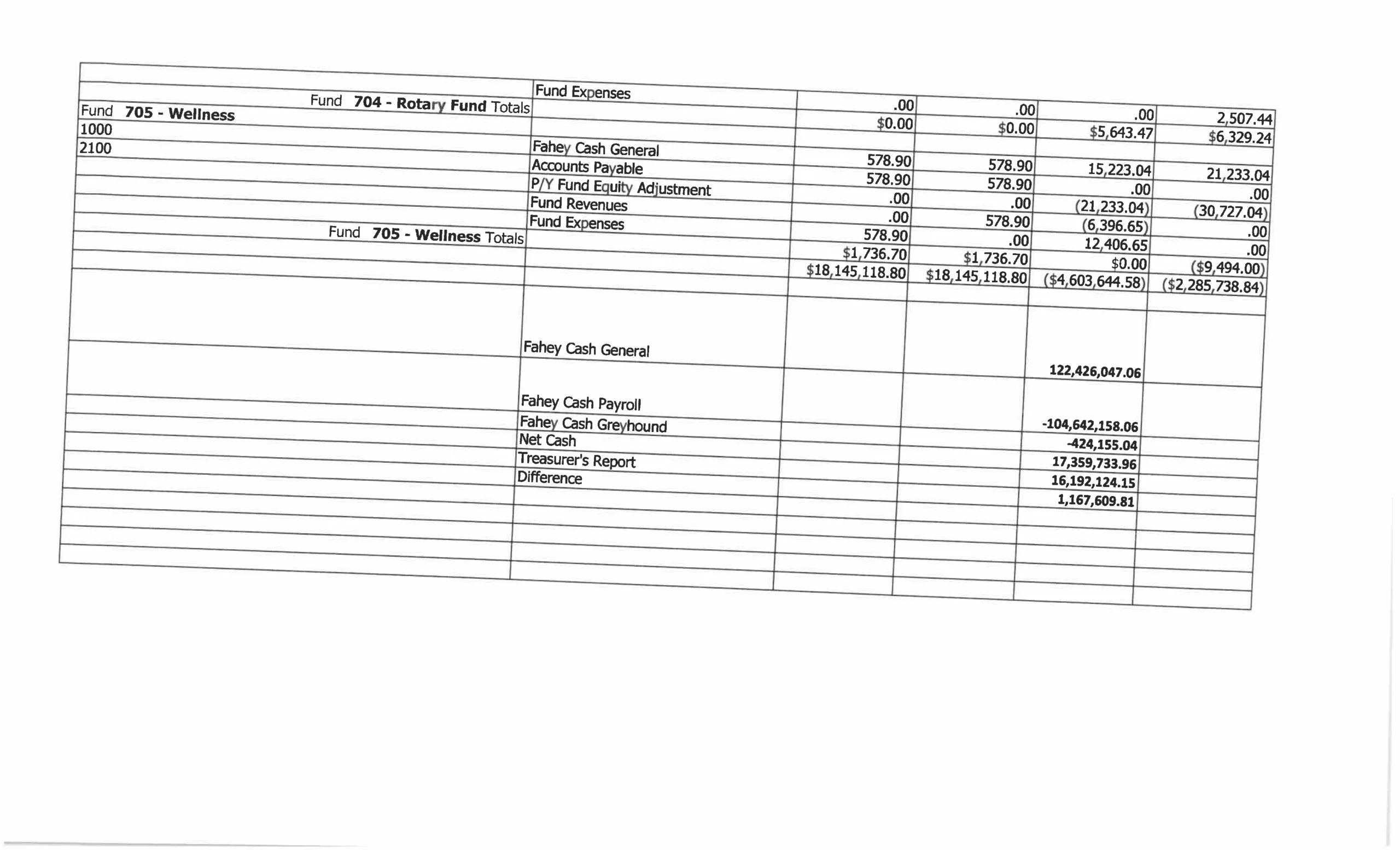

This article uses the city’s own council minutes (1983–2024) to chart the specific moments when the operational and financial structure crumbled, leading directly to the more current chaos including a $16,192,124.15 cash gap and a negative account balance of ($104,642,158.06) in one cash account. See below for the trial balance ledger.

Part 1: A System Designed to Fail (1983–2000)

Marion’s records confirm that financial control issues are historic, existing even before most of the key figures in the current crisis began their careers.

- 1983 (Jan 10): Foundational Compliance Failure. Council minutes reviewed Ordinance No. 1984-30, which was necessary just to authorize the City Auditor to pay bills “pursuant to Ohio Revised Code Section 5705.41 (D).” This shows that even basic functions like paying bills required special state code authority, confirming a severe compliance risk at the city’s core.

- 1985 (Jan 28): The First Tax Burden. An early sign of financial strain was documented as Council passed Ordinance 1984-112 to impose a 3% Transient Occupancy Tax. This tax was needed just to help the city meet its financial matching obligations for sewer construction debt.

- 1998 (Jan 5): Debt Management. The city continued to rely on complex financial tools like the Tax Increment Equivalent Fund (TIF), reviewing Ordinance 1997-163 to manage debt and infrastructure needs, rather than robust general revenue.

- 2001 (June): Budget Crisis Confirmed. The chronic struggle became a public crisis when Councilman Mr. Thomas publicly reported the budget was $2.6 million out of balance, confirming the city was spending money it didn’t have.

Part 2: The Loophole Culture and Insider Theft (2006–2019)

Decades of weak enforcement provided a loophole culture where fraud became possible, eventually leading to a failure to manage new computer systems securely.

- 2006: Internal Theft Exposed. The weakness within the financial office was documented when former Deputy Auditor Kathy Sherer was hit with a $1,173.48 finding for illegally spent money.

- 2007: Warnings Ignored. Dr. Gilsdorf warned Council that the liability for employee time off created a $4.5 million liability, leaving a $2 million deficit for taxpayers to cover.

- 2008: IT Failure Enables Crime. A major technical breakdown was revealed when an audit noted a theft of “several thousand dollars” in the Zoning Office. The crime was possible because the office relied on “paper and pencil” accounting, which meant the employee could easily “cover trails.”

- 2009: Waste Confirmed. Council minutes documented sheer waste, noting the city had spent an estimated $75,000–$100,000 on unused “dead phone lines.”

- Ongoing (Decades): Bypassing the Rules. Councilwoman Mrs. Gustin consistently criticized all city departments for failing to open Purchase Orders (POs) before work was done. This refusal to follow procedure created a systemic loophole for unauthorized spending.

- 2019: New Software Vulnerability Flagged. Concerns about transparency and “blacked out mystery staff” were raised during the implementation of the “New World” financial software, signaling technical vulnerabilities that would soon be exploited.

Part 3: The Digital Collapse and Criminal Admissions (2020–2024)

Historical negligence culminated in active, intentional sabotage, leading to criminal investigations and a total freeze of legislative financial oversight.

The lack of robust, modern IT security is what truly enabled Silent Sabotage to thrive over such a long period. When security controls are weak or missing, insiders—who possess the most knowledge of system flaws—have time to exploit loopholes. It’s a widely known fact among global IT professionals that the installation of new software can introduce vulnerabilities that can be immediately exploited. Given this reality, coupled with the fact that the crucial bank reconciliation module remained broken or disabled from the moment the new system was installed until recently, it is suspected that this particular software may have been chosen because of its known, exploitable weaknesses. This prolonged system failure confirmed that financial data could be manipulated without being caught.

- 2020 (Sept): Data is Worthless. The city’s records officially collapsed, showing a $16,192,124.15 cash gap and a horrifying ($104,642,158.06) negative balance.

- 2020–2022: The Missing Check-Up Tool. Former Auditor Robert Landon III failed to send employee taxes, causing a $154,399 finding for IRS penalties. This crucial error was missed because the bank reconciliation module—the software tool needed to check the books—was broken. In November 2022, Council passed Ordinance 2022-095 to hire a firm just to perform the missing reconciliation. A move that Robert Landon III had previously suggested and was denied.

- 2023 (July 24): The Cost of Repair. Veritas Solutions Group reported the reconciliation was complete, resulting in 90 journal entries and a net expense impact of $1,464,000 for 2021 alone.

- 2023–2024: Criminal Admission and Fraud. Former Auditor Miranda Meginness admitted to fraud and intentionally used the financial system to “hide the payment” of an IRS penalty, using “false documentation.” She faced a $225,000 penalty bill from the IRS.

- 2024 (Mar 25): Oversight Freezes. Finance Chair Ms. Laing publicly declared she would not call further Finance Committee meetings until she received “accurate and current budget performance reports,” freezing legislative financial oversight. Councilman Ratliff noted Auditor Meginness had taken no action to file a criminal report on a $12,000 wire transfer scam he had asked her to report a month prior.

- 2024 (Current): Intentional Sabotage. Current officials confirmed that crucial control features or “switches” in the software were turned off, disabled, or never installed. Attempts to fix these controls caused drastic issues with other modules, confirming the intentional sabotage suspected by Marion Watch.

The Path to Accountability

The records confirm that the city’s financial and IT issues are deeply rooted, reaching back to at least 1983. The ensuing chaos is the direct result of this multi-decade failure to fix the fundamentals.

The city must now:

- Mandate a Forensic IT Audit: This is the only way to get the digital evidence needed to fully trace the funds and identify who intentionally disabled the software controls.

- Fix Internal Controls: The reconciliation module and flawed software must be immediately restored or replaced, and rules like segregation of duties must be strictly enforced.

- Ensure Accountability: All those responsible for the fraud (like Meginness and Nwosu) and the negligence ( and the IT breaches) must be held fully accountable to restore public trust.

Works Cited

Marion City Council Minutes 1983-2024:

https://drive.google.com/drive/folders/1t9G_JyojeV0bY5Pbw4veXGaKbZW7kDqi?usp=sharing